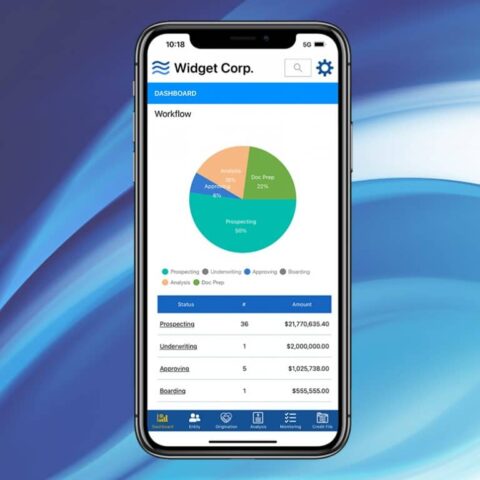

Global Wave Group and Compliance Systems Partnership

Global Wave Group LLC, a leading provider of Commercial Loan Origination Systems, has partnered with Compliance Systems to offer a seamless solution allowing banks and credit unions a highly efficient, end-to-end process for the analyzing, approving, monitoring, and documenting commercial loans.