Simplify your Borrower’s journey with digital loan applications and electronic document submission fully compliant

It can be challenging to strike a good balance between competing with the fast pace of larger organizations using automation while still maintaining community relationships and meeting customer expectations. GWG’s digital loan application software helps you bridge that gap.

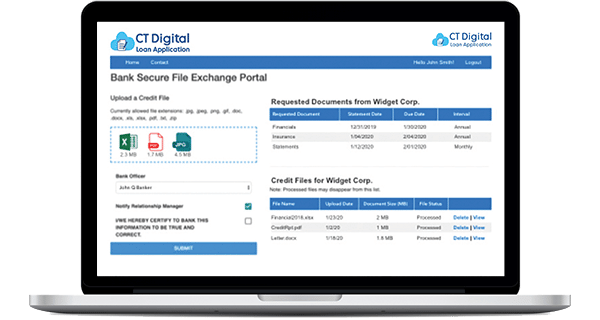

CT Digital allows an Institution’s customers to submit loan applications and related documents in an automated, secure manner allowing you to gain further operational efficiencies. Fully integrated with our Credit Track platform, CT Digital is directly tied to our scoring, spreading, workflow and decisioning engines.

As your institution looks for ways to streamline its digital processes to create a more seamless user experience, you still often face strict compliance hurdles and obligations. GWG’s solutions are built with compliance in mind to ensure you are prepared for audits and regulatory visits from the start.

Our solutions offer fully compliant, configurable modules designed to integrate with your institution's unique processes, ensuring a smooth transition to compliance.

These modules allow the safekeeping of borrower demographics and loan data to ensure that you are compliant from the application intake process and throughout your loan cycle.

The financial institution can govern the “1071 Firewall” using Global Wave’s solution to ensure that certain required clearances have access while not slowing down or impeding collaboration or the loan process itself.

Is your institution evaluating alternatives for credit risk management and loan processing automation? Are you looking for specific features such as covenant and tickler management, stress testing or custom reporting?

Please fill out the form below to schedule a live preview of our solutions. No hard sell, no eye candy, no nonsense – just a consultative discussion with one of our Consultants on how to best address your needs, concerns and issues.

You can also call us, and we’ll be happy to schedule a time for a live product demo. Our phone number is 888-315-4704.

Global Wave Group, LLC

26970 Aliso Viejo Pkwy, Suite 250

Aliso Viejo, CA 92656