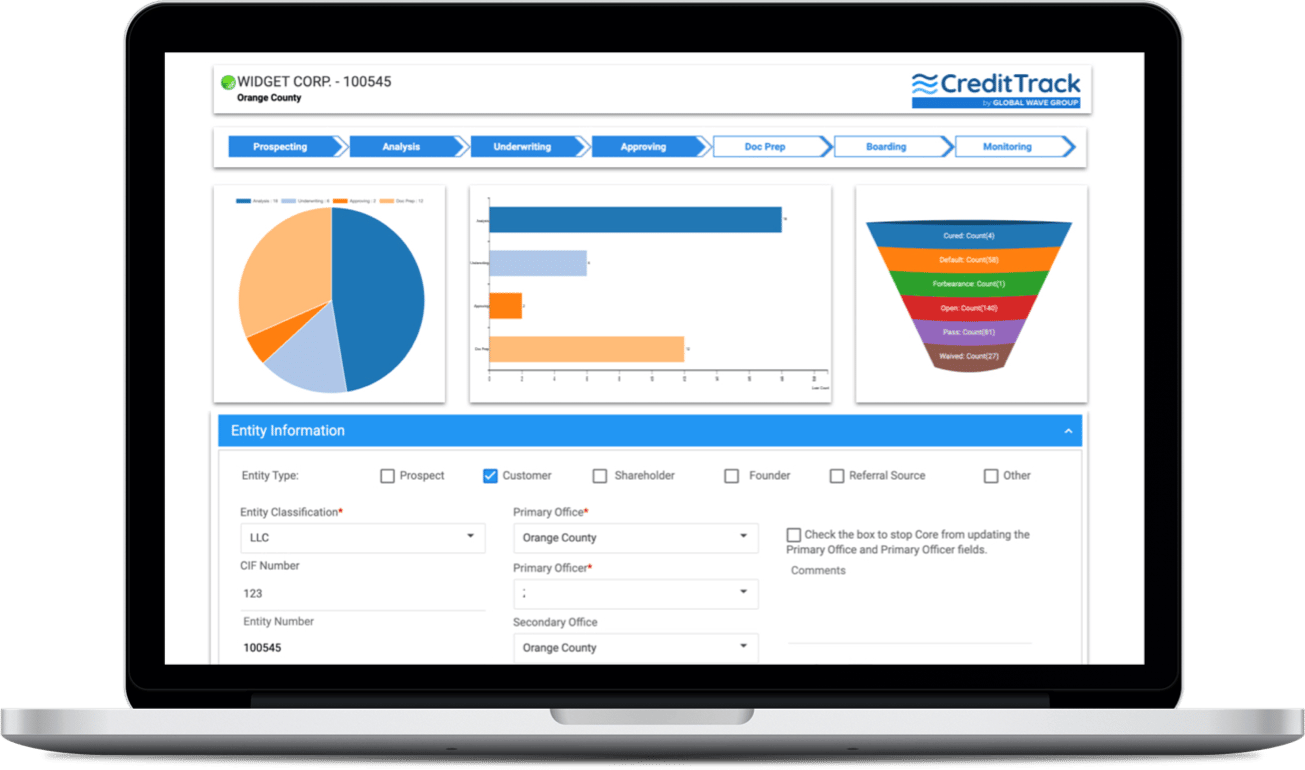

Fully automate the entire commercial loan life-cycle from sales management to monitoring

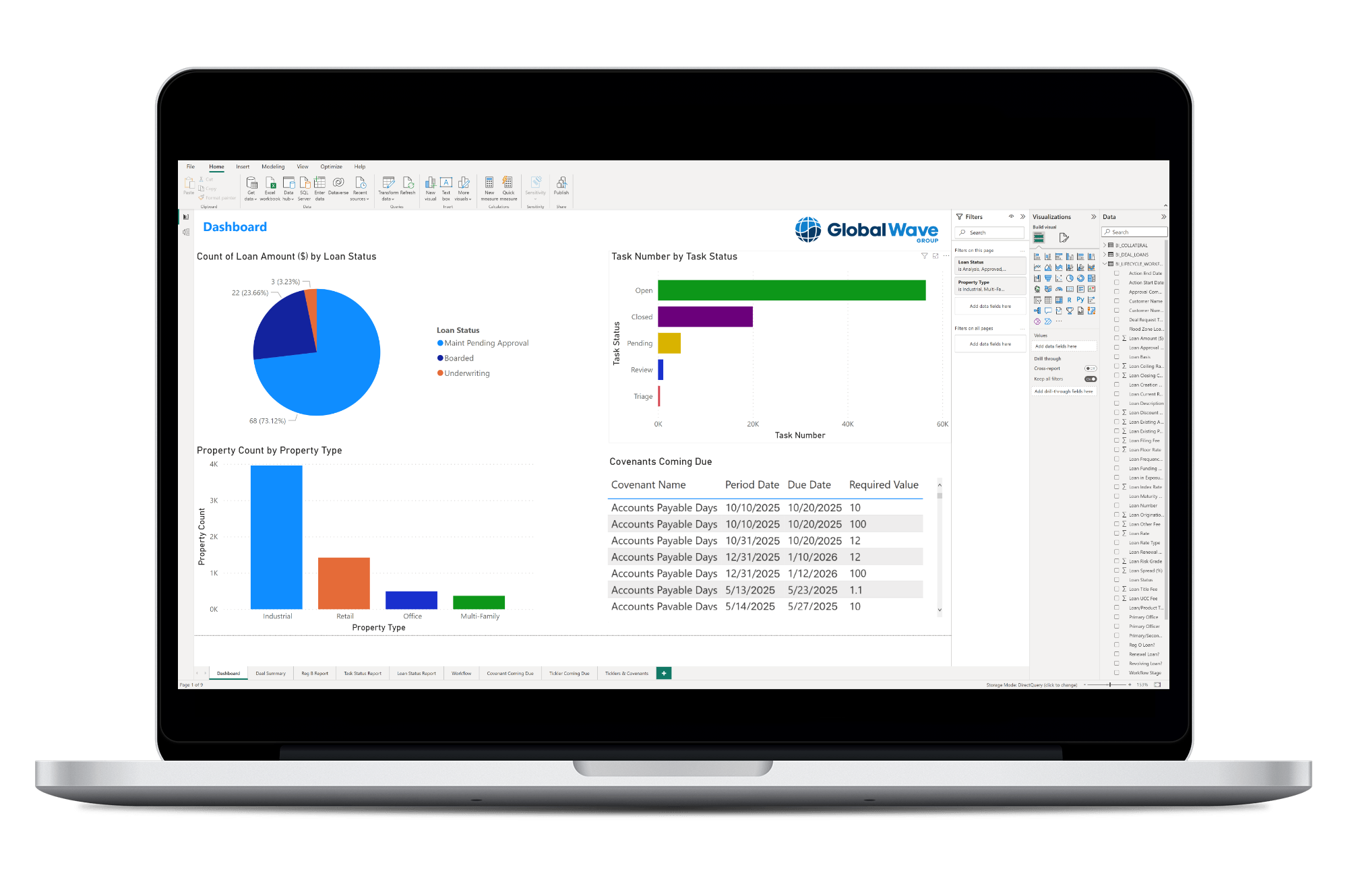

Manage your loan portfolio and mitigate credit risks by streamlining the lending process with automations and digitization. Credit Track integrates with all existing Core Banking solutions and most documentation preparation solutions. This translates into faster processing times and reduced costs, enabling your bank, credit union, or financial institution to grow its loan portfolio and have a unified view to make informed decisions. Credit Track is built by bankers for bankers, with an intuitive user interface and fewer clicks to enhance productivity and create a seamless user experience.

Automated credit scoring on digital loan applications allows your financial institution to create a better borrower experience, delivering service with speed and efficiency. Credit Track also uses thoughtful decisioning automation with offramps when loan applications need manual review based on your institution’s policy. This allows you to stay competitive in a demanding market while maintaining relationships within your community.

Workflow and collaboration are built into Credit Track. At any time, you can see exactly who has the deal and how long they’ve had it. We also provide metrics to monitor delays or issues along the way.

Credit Track allows you to gain control of compliance at the start of your lending process. Reduce audit flags by 70% and be prepared for your financial institution’s upcoming 1071 readiness due date. GWG integrates 1071 directly into Credit Track automatically populating data into the system for you. The user interface intuitively shows the logic of the 1071 form to ensure that your team can easily complete the logic of the lengthy 1071 form, saving you time and manual errors. With Credit Track you can also give auditors specific access to respond quickly to requests.

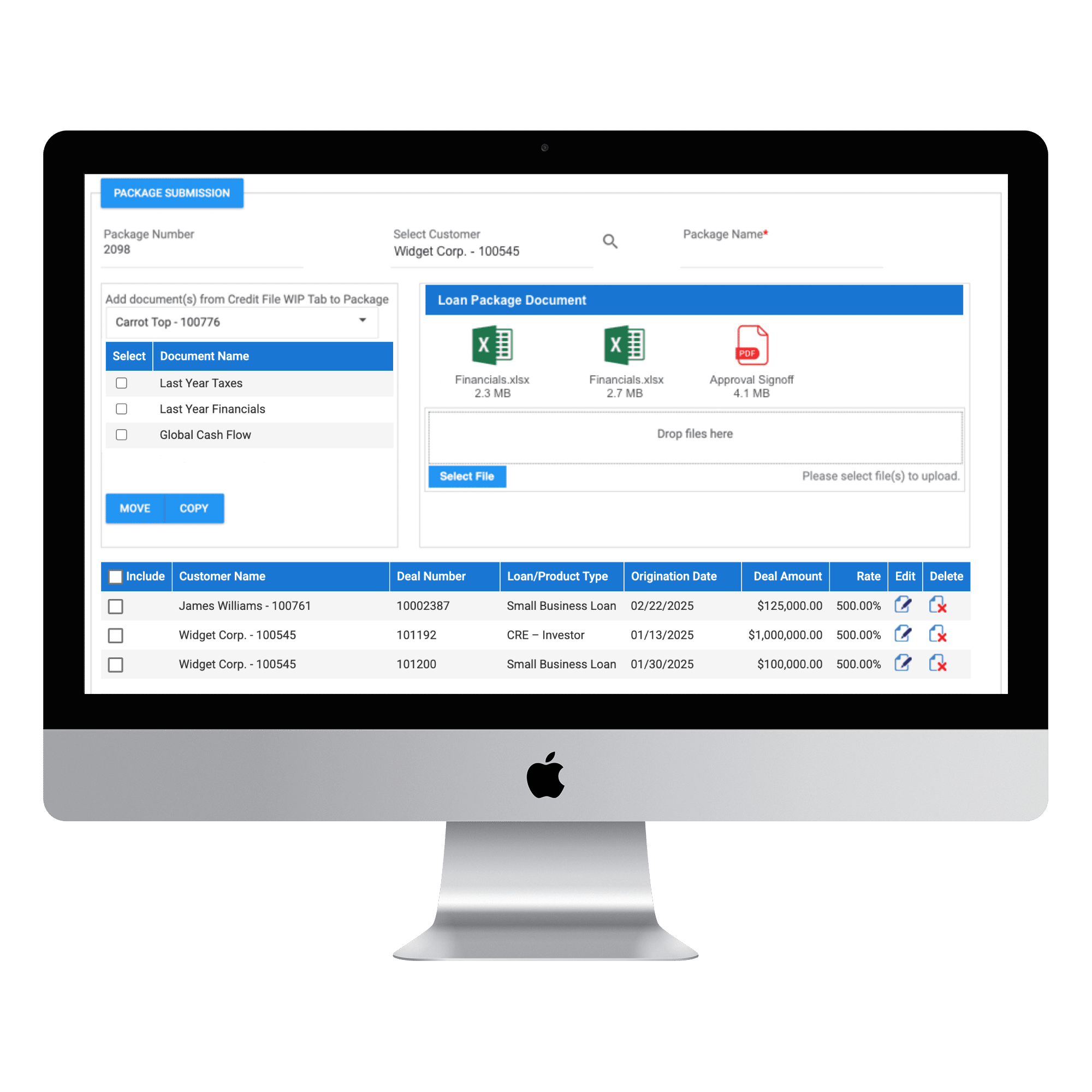

Formalize and streamline your application intake process while also giving borrowers the easy online access they have come to expect. With CT Digital Loan Application, both new and existing clients have access to digital loan applications to easily apply with a range of built-in automation. You can also reduce risk and provide your clients a secure borrower portal to send financial documents to our CT Digital platform.

We created a powerful yet convenient tool to input financial data in an Excel-like experience. Included are extensive analytics to modify and define various accounts, ascertain projections, and model cash flows. Spreading templates are available for Agriculture, Business Owner, CRE, Non-profit, Auto Dealerships, C&I, and more. Simple to implement, easy to standardize, highly cost-effective, and we can import all your legacy spreading data.

Is your institution evaluating alternatives for credit risk management and loan processing automation? Are you looking for specific features such as covenant and tickler management, stress testing or custom reporting?

Please fill out the form below to schedule a live preview of our solutions. No hard sell, no eye candy, no nonsense – just a consultative discussion with one of our Consultants on how to best address your needs, concerns and issues.

You can also call us, and we’ll be happy to schedule a time for a live product demo. Our phone number is 888-315-4704.

Global Wave Group, LLC

26970 Aliso Viejo Pkwy, Suite 250

Aliso Viejo, CA 92656